It is the only case we are aware of where shareholders have sued for compensation arising from a misleading prospectus. By suing in March 2019, they missed a six-year deadline imposed under limitations law.

The judge ruled that the shareholders suffered loss and damage when they bought shares of Trony back in 2010-2012-and not when the company was eventually de-listed in August 2018. On 28 September a High Court judge said they were time-barred from pursuing their action.

Unfortunately, the Trony 35 lost at the first hurdle. A “no win, no fee” arrangement to ease the financial burden is also still firmly off the table in Hong Kong where lawyers are still prosecuted for champerty and maintenance. The prohibitively high cost of going to court and a “loser pays” system is still a mighty deterrent to individual investors. Instead, the securities regulator, the Securities and Futures Commission (SFC), takes on the most egregious breaches of securities law on behalf of shareholders. It did not turn out to be a brave new world. One of the major prongs of the legislation was to empower shareholders with a new right of action, rather than having to fashion the claim in traditional tort or contract terms: if you are injured by another person’s flouting of securities laws, you can apply to the court for remedies. They sought damages representing the amount they paid for the shares including the value, and any other charges and fees.īack in the early 2000s, there was much talk of investors asserting their rights as guaranteed under the Securities and Futures Ordinance (SFO), which came into effect in 2003. They argued that their shares in Trony were rendered valueless by the loss of the company’s listing status.

Trony solar series#

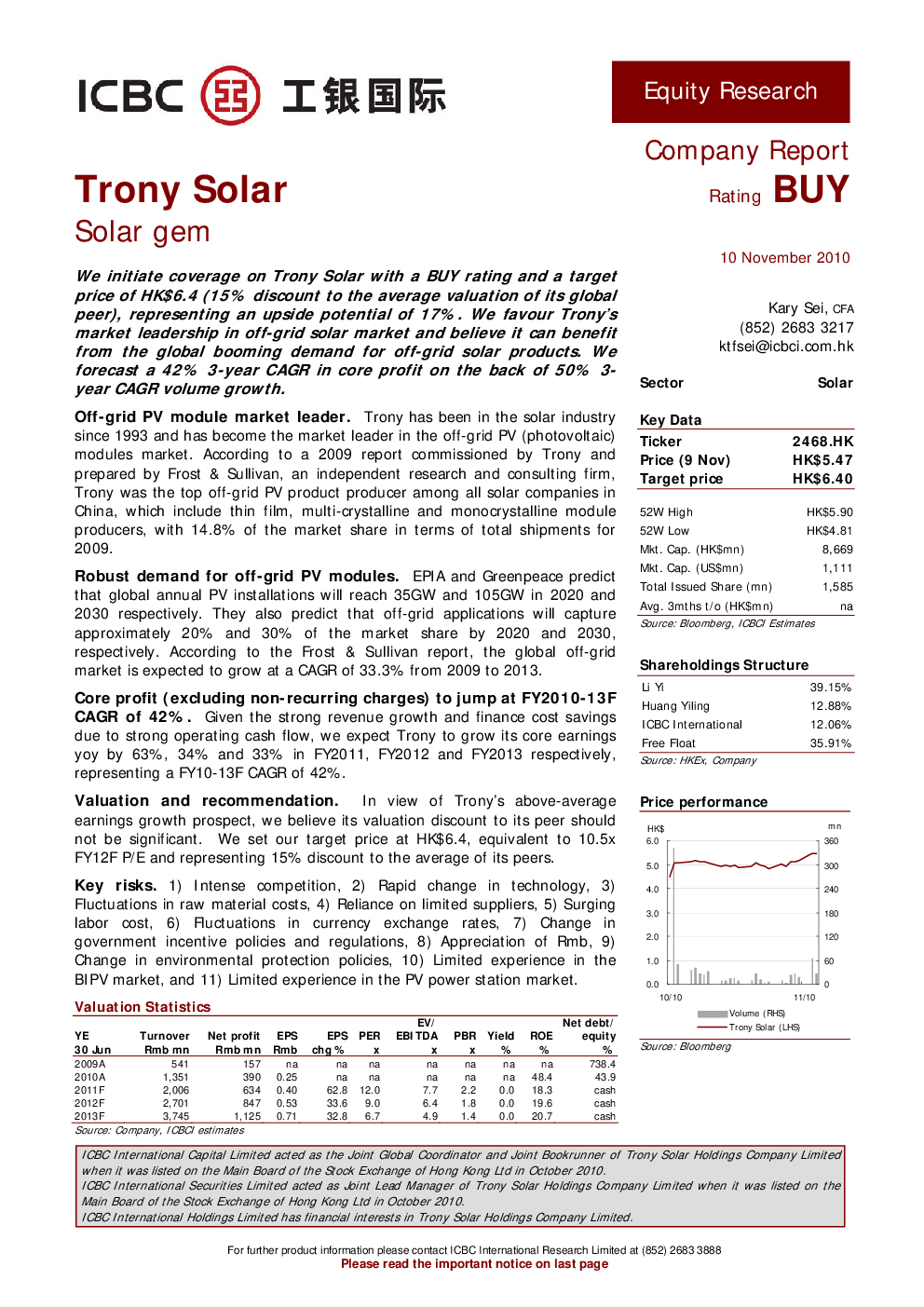

After an IPO in October 2010, the company had requested a suspension in June 2012 after a whistleblower wrote to Deloitte with a series of allegations.Ī group of 35 shareholders filed a lawsuit in Hong Kong in March 2019 seeking compensation against Trony sponsor JP Morgan Securities (Asia Pacific) and the issuer’s auditor, Deloitte for misleading statements made in the IPO prospectus.

In all, it traded publicly for just 18 months. The story seems to end in August 2018 when Trony was finally de-listed. This was amid concerns that materially false, incomplete, or misleading information had been included in the company’s IPO prospectus. Unable to reconcile the three sets of figures, and with uncooperative employees-including a chairman and CEO who claimed his company laptop was stolen in a coffee shop-the company was eventually booted off the bourse by Hong Kong Exchanges and Clearing (HKEX). The last you probably read about a small China-based solar panel company, Trony Solar Holdings, back in 2014 was that a forensic probe had found three sets of books and accounts at its main operating subsidiary in Shenzhen. That is why the case of the Trony 35 is so compelling-even if it does not have a happy ending. It is relatively unheard of for investors in Hong Kong to get lawyered up as a group and talk about compensation.

The board vanishes, the firm de-lists, shareholders take a hit and the market moves on. The past two decades has seen a fair number of companies list in Hong Kong and quickly unravel as findings of fabricated invoices, bogus accounts and plundered assets come to light. ACGA Research Director Jane Moir reports on a very rare event

0 kommentar(er)

0 kommentar(er)